utah food tax referendum

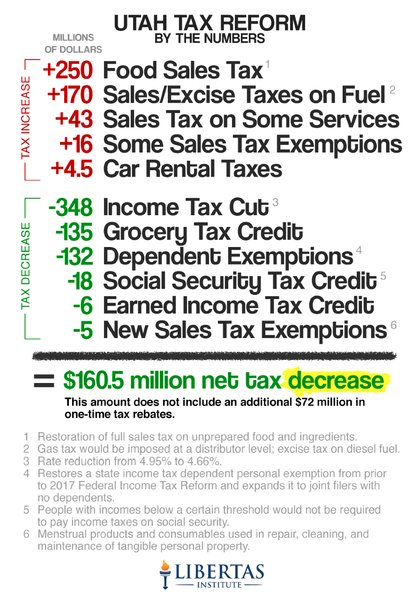

21 to sign the 2019 Tax Referendum in opposition to the looming 177 food tax increase. Among other things SB 2001 was designed to make the following changes.

Voices For Utah Children Invest In Utah S Future Not Tax Cuts

Utah just passed a tax reform bill that raised the.

. Associated Food Stores has become the latest to allow signature-gathering for a referendum challenging the Utah State Legislatures tax overhaul bill. Full text of measure This referendum effort sought to repeal Utah Senate Bill 2001 titled Tax Restructuring Revisions. The new tax reform law passed earlier this month in a special session of the Utah Legislature also lowers the state income tax rate and provides tax breaks to low- and.

Organizers of a voter-led effort to repeal the Utah food tax through a ballot initiative next fall announced earlier this week they had gathered more than 152000 signatures. And Utah Justice. What would the referendum have done.

Decrease the individual inco See more. The West Valley City Utah-based grocer invited customers through Jan. Income tax cuts benefit the rich while sales tax on food hurts the poor.

Its a regressive tax that unfairly impacts the economically poor. SALT LAKE CITY A citizen referendum has been filed challenging the massive tax overhaul bill passed by the Utah State Legislature in special session. And the state will also send out a prebate check related to the food sales tax.

Harmons Grocery is joining in opposing the food tax increase from 175 to 485 by opening its 19 statewide stores for people to come in and sign the Utah 2019 Tax. A citizen referendum was filed Monday challenging a tax reform bill that. The Utah End Food Taxes Initiative was on the November 1990 statewide ballot in Utah where it failed with 442 of voters in favorIt was one of three statewide ballot measures that year in.

Trent Nelson The Salt Lake Tribune Judy Weeks Rohner left turns in signed tax referendum. Taxing grocery store food unfairly places the burden on the most vulnerable. Rohner led a referendum effort to stop the 2019 Utah Legislature tax reform package which would have created a 31 increase on the state sales tax on groceries a.

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

Harmons Leads Race To Oppose Utah Food Tax Increase

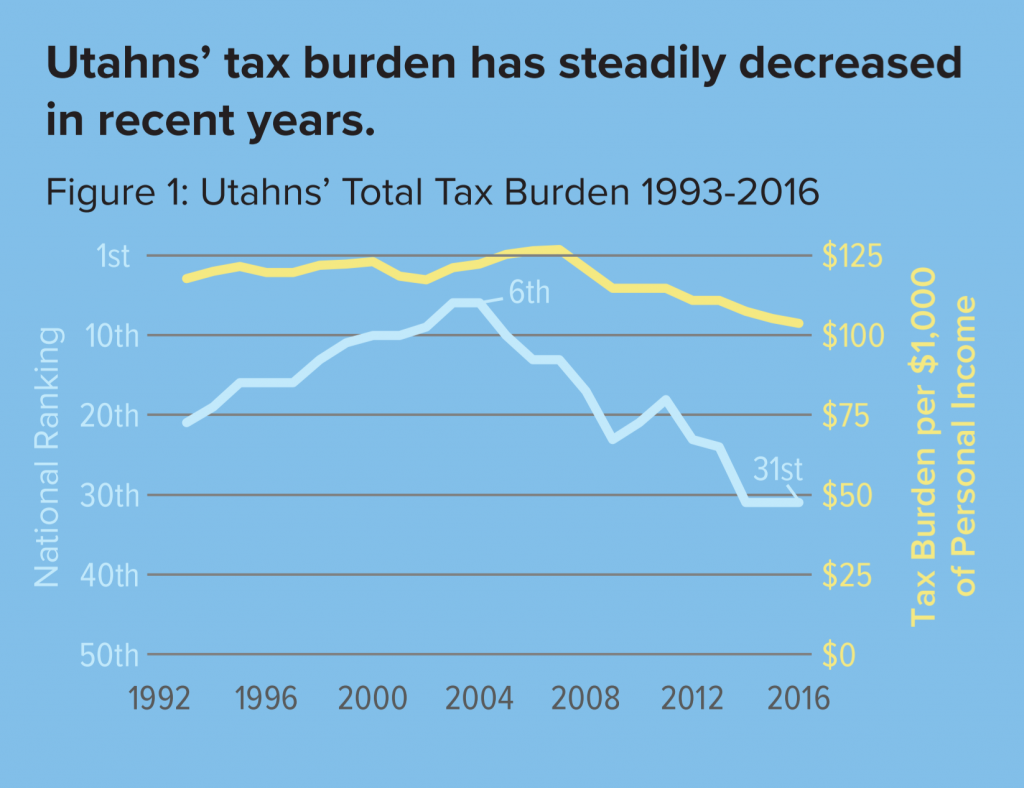

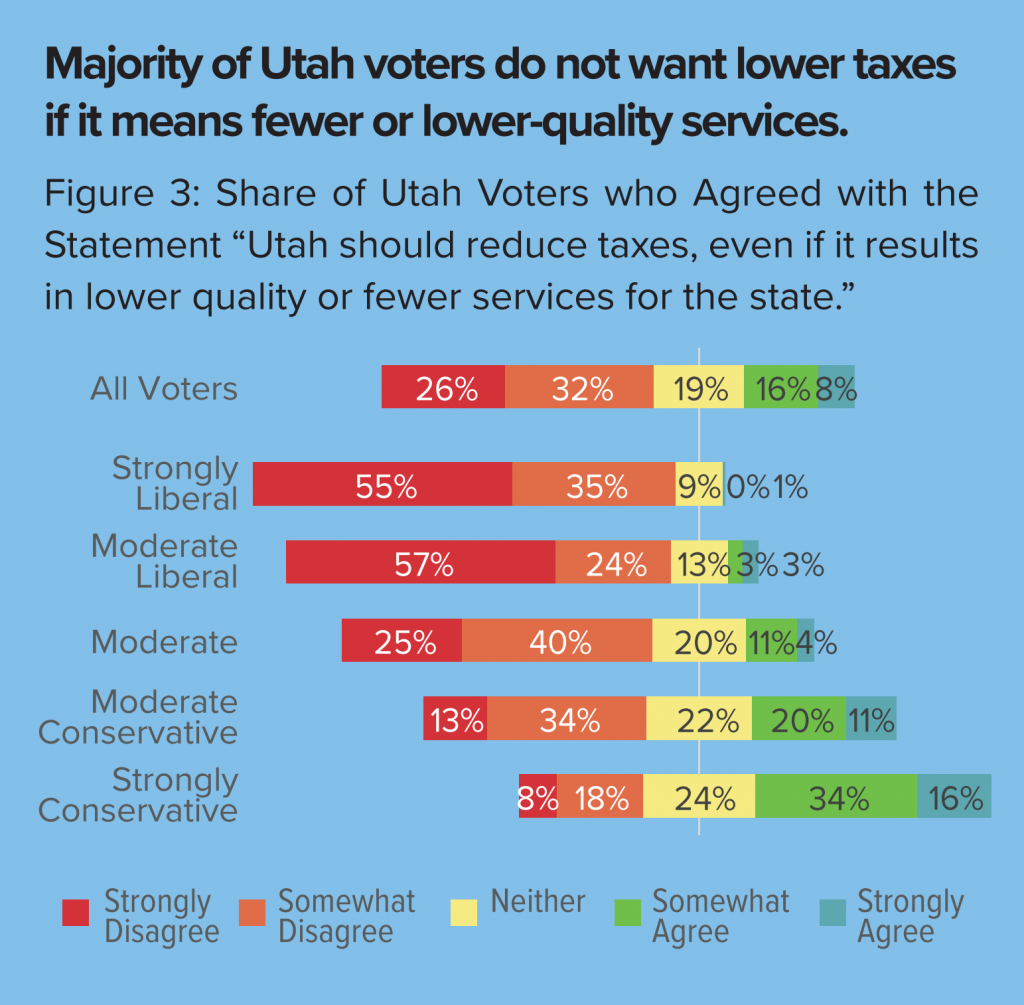

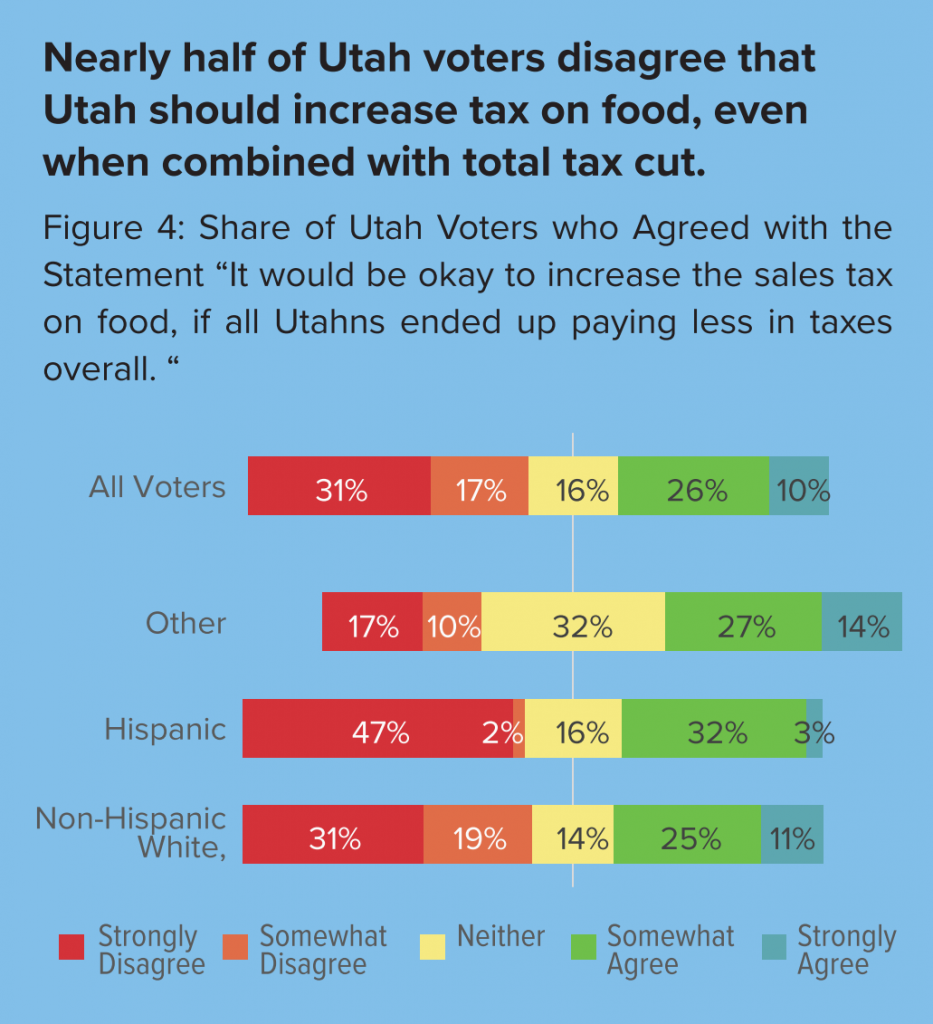

Utah Priorities 2020 Utah Priority No 2 State Taxes And Spending Utah Foundation

Utah Priorities 2020 Utah Priority No 2 State Taxes And Spending Utah Foundation

Utah Tax Increases Real Salt Lake In Mls Cup Police Fees Hits Misses Salt Lake City Salt Lake City Weekly

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Kutv 2news Under The New Bill Utah S Food Tax Will Jump Facebook

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Opponents Of Proposed Food Sales Tax Increase Say Low Income Families Will Suffer

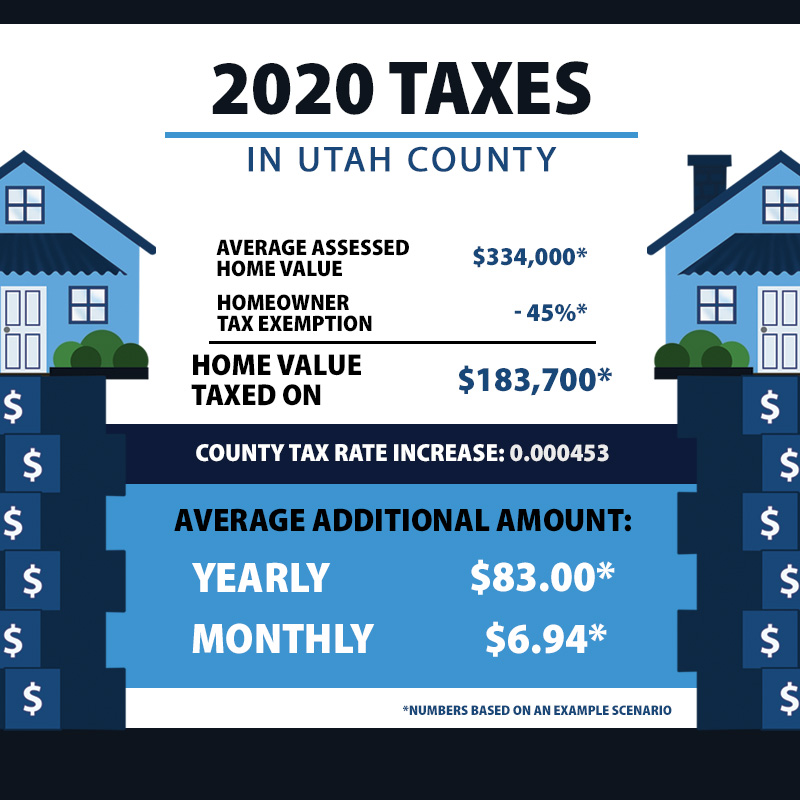

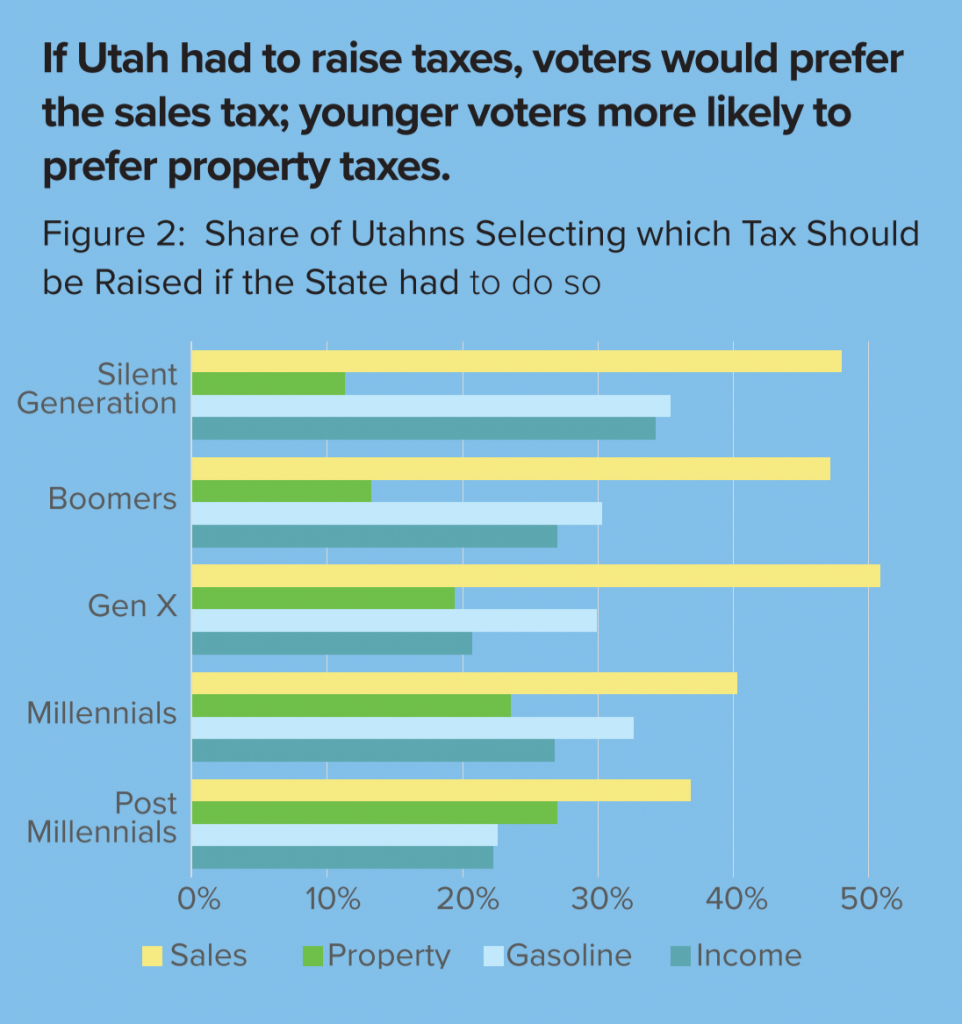

Utah Priorities 2020 Utah Priority No 2 State Taxes And Spending Utah Foundation

Utah Tax Reform Provisions Repealed

Gop Leaders Propose Dropping Public Education Earmark On Income Tax Deseret News

Will Utah Repeal Its State Sales Tax On Food Deseret News

Where Has Utah S Tax Reform Landed Libertas Institute

Utah Priorities 2020 Utah Priority No 2 State Taxes And Spending Utah Foundation

State Legislators Discuss Raising Utah S Sales Tax On Food From 1 75 To Nearly 5 Kutv

Utah Priorities 2020 Utah Priority No 2 State Taxes And Spending Utah Foundation

With Grocery Costs Rising Lawmakers And Religious Leaders Say Utah Should Eliminate 1 75 Food Tax Ksl Com